Green Card Bureau

From 1 January 2025, the green card issued in electronic form will no longer have to be printed out by the vehicle owner.

This was decided by the General Assembly of the Central Organisation of the International Green Card Scheme (COB) in the summer of 2024. From now on, the holder can choose to present the green card to the authorities in paper or electronic PDF format, regardless of the software, hardware or operating system on which it is presented.

The organisation has decided that from 1 January 2025, authorities in all EU Member States will have to accept green cards in PDF format on a portable electronic device (e.g. smartphone, tablet) from foreign motorists visiting their country. This does not require any special technical device or application (e.g. QR code reader) to be used by the authorities. The only practical change is that instead of a printed green card, the same document will be checked on the basis of its electronic image.

The only practical change is that instead of a printed green card, the same document will be checked against an electronically displayed image. The use of traditional paper green cards will remain unchanged and will be presented and checked in the same way as before. In all cases, where the electronic version is not available or is not to be used by the holder, the green card must be printed on white paper in black ink on A/4 format. The technical implementation of the green card in the form of an electronic-only certificate is still pending, but is being negotiated.

The Association of Hungarian Insurance Companies, as the National Bureau, is of the opinion that the introduction of the new electronic green card does not require any changes to the existing Hungarian legislation and the Hungarian authorities have stated that they are ready to implement the new practice from 1 January 2025.

We remind our customers that insurance companies will send a separate customer information leaflet on the change to all drivers with compulsory third party liability insurance.

Association of Hungarian Insurance Companies

As per the definition determined by Act LXII of 2009 on Insurance Against Civil Liability in Respect of the Use of Motor Vehicles, the National Bureau is an organisation of Hungarian motor insurers providing compulsory motor liability insurance cover. This organisation is taking care of tasks related to co-ordination, the claims handling and settlements in the framework of the international Green Card System.

Compulsory motor liability insurance was established in Europe between the First and Second World Wars in order to ensure the necessary indemnity for the traffic victims.

In June 1952 the resolution of the Inland Transport Committee established the Green Card System with the participation of eight countries with effect from 1st January 1953. The eight countries were: Austria, Belgium, France, Netherlands, Great Britain, Sweden, Switzerland and the Federal Republic of Germany. Within a half-year, another four countries (Denmark, Norway, Finland, Ireland) joined this system. In the next few years, most European countries followed them. Hungary has been participating in the Green Card system since 1961.

With a permanent location in London (and co-operating with the Economic Commission for Europe of the United Nations), the Council of Bureaux (CoB) is the main governing and representative body of the Green Card System. (established in November 1951.)

The Green Card Agreement is based on two principles:

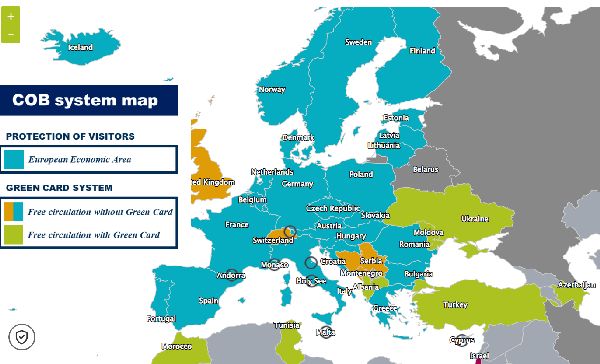

Due to the increase of the international motor vehicle traffic the idea to facilitate the operation of the system changed in spite of the satisfactory functioning of the Green Card system. The members of the Green Card system raised the idea of concluding supplementary agreements which are aimed at the elimination of producing and controlling the Green Card as a documentary evidence of the insurance cover.

During the parallel operation of the Uniform Agreement and its further development, the Multilateral Guarantee Agreement the idea of unification of the two agreements was first raised in 1999. The differences in the texts and as a consequence of this the different interpretations underlined the necessity of the unification.

According to Directive 2009/103/EC (Motor Insurance Directive), every vehicle normally based in the territory of a third country must, before entering the territory of Hungary, be provided either with a valid Green Card or with a certificate of frontier insurance establishing that the vehicle is insured in accordance with the Directive.